Chapter 8: Receivables, Bad Debt Expense, and Interest Revenue

Objective 8.1: Describe the trade-offs of extending credit.

Pros and Cons of Extending Credit

Advantage: Encourages the customer to buy more goods/services, so revenue goes up.

Disadvantages:

Increase in wage costs: Employees are hired to see if someone is creditworthy, see how much money people owe, and to collect from customers.

Bad debt costs: Sometimes people don’t pay what they owe.

Delays receipt of cash: Receiving cash from customers can take 30-60 days.

Objective 8.2: Estimate and report the effects of uncollectible accounts.

Accounts Receivable and Bad Debts

When accounts receivables aren’t fully paid off, it results in bad debt.

There are two objectives in relation to accounts receivable and bad debts:

Accounts Receivable is recorded at the value that is expected to be collected, aka “net realizable value”.

Match (matching principle) the estimated cost of bad debts to the accounting period related credit sales are made.

Both objectives result in a decrease in Accounts Receivable and Net Income by the credit estimated to not be collected.

You must record Sales Revenue and Bad Debt Expense in the same period of the sale. This is called the expense recognition principle (matching).

The allowance method is estimating bad debts that may not be collected and adjusting these estimations later.

Allowance for Doubtful Accounts is a contra account to Accounts Receivable and has a normal credit balance.

When an account can not be collected, the account must be written off.

The balance is removed from Accounts Receivable and Allowance for Doubtful Accounts.

Debit Allowance for Doubtful Accounts

Credit Accounts Receivable

Write offs DO NOT appear on the Income Statement.

Equation to calculate net receivable value:

Accounts Receivable - Allowance for Doubtful Accounts = Net Receivable Value

Journal entries:

Record sales on account:

Debit Accounts Receivable

Credit Sales Revenue

Record estimate of bad debts:

Debit Bad Debt Expense

Credit Allowance for Doubtful Allowance

Bad debt know (“write off” day):

Debit Allowance for Doubtful Accounts

Credit Accounts Receivable

Example: A company sells a bike for $300 to a customer who pays on account. An asset increases and revenues increases.

Accounts Receivable | $300 | ||

|---|---|---|---|

Sales Revenue | $300 |

Example: The company expects to receive $300, but records it estimated bad debt. An expense increases and a contra account increases.

Bad Debt Expense | $300 | ||

|---|---|---|---|

Allowance for Doubtful Accounts | $300 |

Example: The company writes off the bad account. A contra account decreases and the asset decreases.

Allowance for Doubtful Accounts | $300 | ||

|---|---|---|---|

Accounts Receivable | $300 |

Methods for Estimating Bad Debts

There are two methods to calculate the estimate of bad debt: Percentage of Credit Sales Method and Aging of Accounts Receivable

Percentage of Credit Sales Method

Aka the Income Statement Account.

Estimates Bad Debt Expense for the period.

Not very precise.

Equation for estimating bad debt expense (% of credit sales method):

Historical percentage of bad debt loss x Current period’s credit sales

Example: A company has bad debt loss of 3/4. Their credit sales in March totaled $150,000.

Historical percentage of bad debt loss = 75%

Current period’s credit sales = $150,000

$150,000 x 0.0075 = $1,125

Aging of Accounts Receivable

Aka the Balance Sheet Method.

Estimates the ending balance in the Allowance for Doubtful Accounts.

Bases its estimate off of the age of each amount in Accounts Receivable at the end of the accounting period.

If the account receivable is old and overdue, it is less likely to be collected.

More complicated than the first one, but it more accurate.

Steps for the Aging of Accounts Receivable:

Prepare an aged listing of accounts receivable.

Estimate the bad debt loss percentages for each category.

Compute the total estimated bad debts

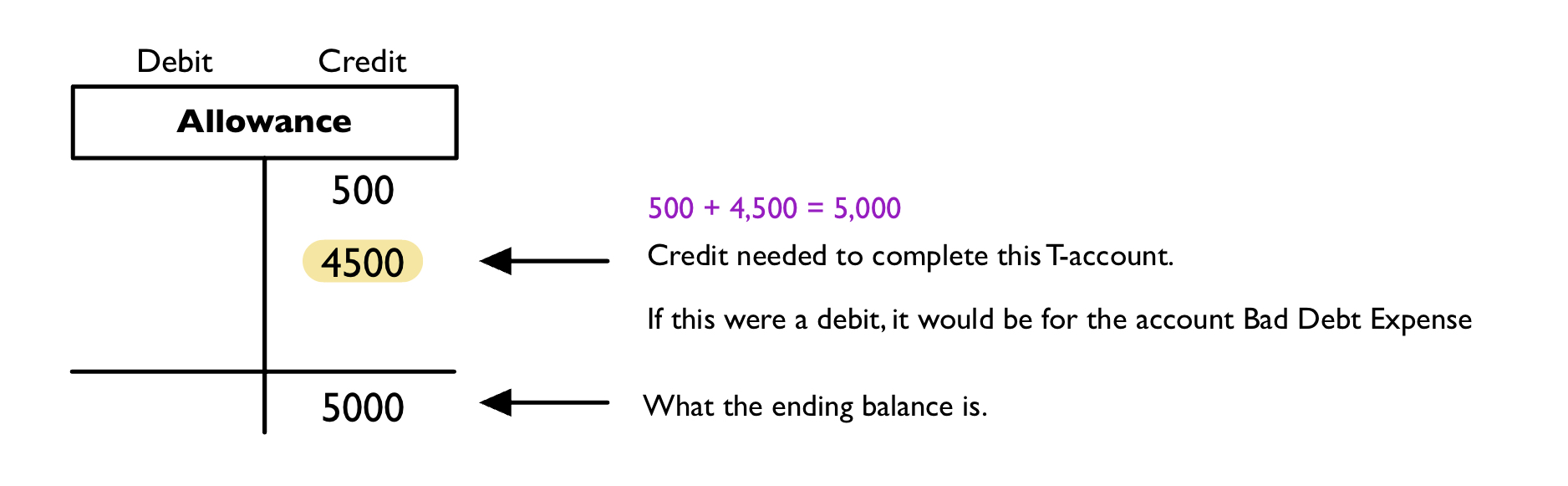

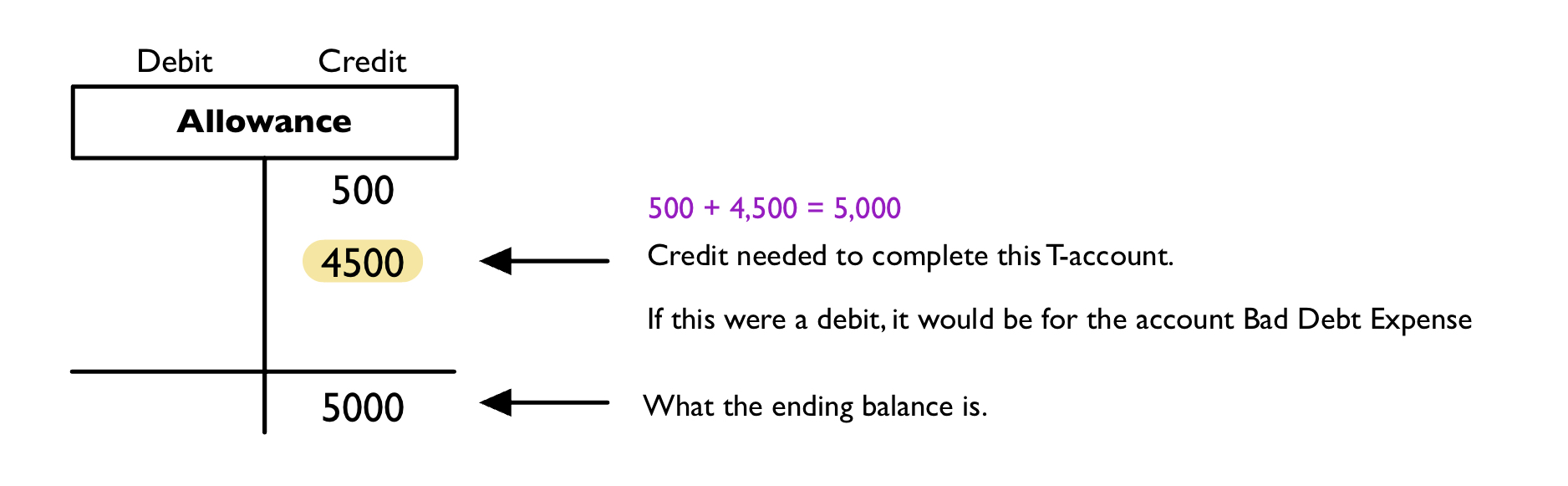

Example: $5,000 of a company’s Accounts Receivable are estimated to be uncollectible. The unadjusted credit balance for Allowance of Doubt Accounts is $500.

We know that the beginning balance in the Allowance for Doubtful Accounts is $500.

We know the ending balance is $5,000.

We want to fill in what the adjusted entry should look like on the T-account.

Other Issues

We never expect the estimate to match perfectly. There is always going to be a little bit of a difference. If we are significantly off, we have to increase our percentages.

Revising estimates is when a company revises their bad debt estimates for the current period.

Account recovery is reviving written off accounts. The receivable is put back on the books by recording the opposite of what is done for writing off an account. After, a company records the collection of the account.

An example of an account recovery is getting a check in the mail after writing off an account. The company initially thought they would not receive payment, but they did so a journal entry is needed.

There will always be 2 journal entries for a recovery.

Journal entry for reversing the write off:

Debit Accounts Receivable

Credit Allowance for Doubtful Accounts

Journal entry for the collection of the account:

Debit Cash

Credit Accounts Receivable

Example: A company collects $300 for a bike sold, but previously written off. Write the two journal entries: reverse the write off and collect the cash.

Account Receivables | $300 | ||

|---|---|---|---|

Allowance | $300 | ||

Cash | $300 | ||

Accounts Receivable | $300 |

Objective 8.3: Compute and report interest on notes receivable.

Notes Receivable and Interest Revenue

A Notes Receivable is reported when a promissory note is used for a transaction. It has a stronger legal claim.

Notes receivables charge interest from the date they are created to when they are due.

The day the Notes Receivable is due is called the maturity date.

A company may use a Notes Receivable for:

Loaning money out to employees or businesses.

Receiving extended payment on expensive items.

Switching from Accounts Receivable to Notes Receivable to extend the payment period.

Calculating Interest

Three numbers are needed to calculate interest:

Principal - the amount of the Note Receivable.

Interest Rate - interest percentage charged on the note. They are always an annual percentage.

Time Period - the amount of time covered in the interest. Can be in months or days (12, 365)

Equation to calculate interest:

Principal (P) x Interest Rate (R) x Time (T) = Interest (I)

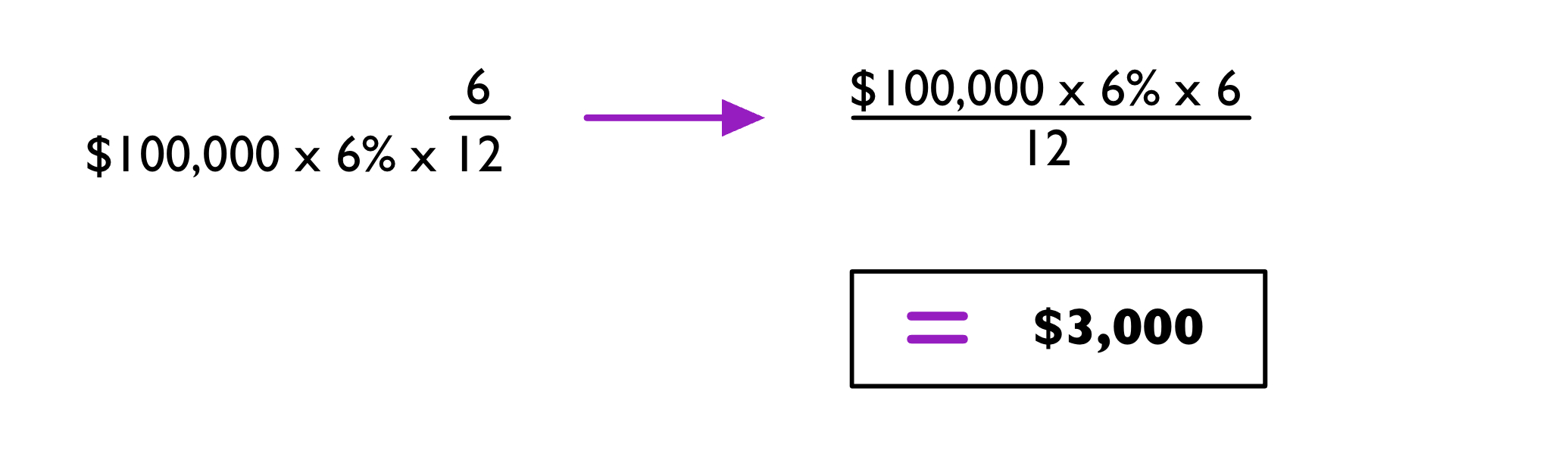

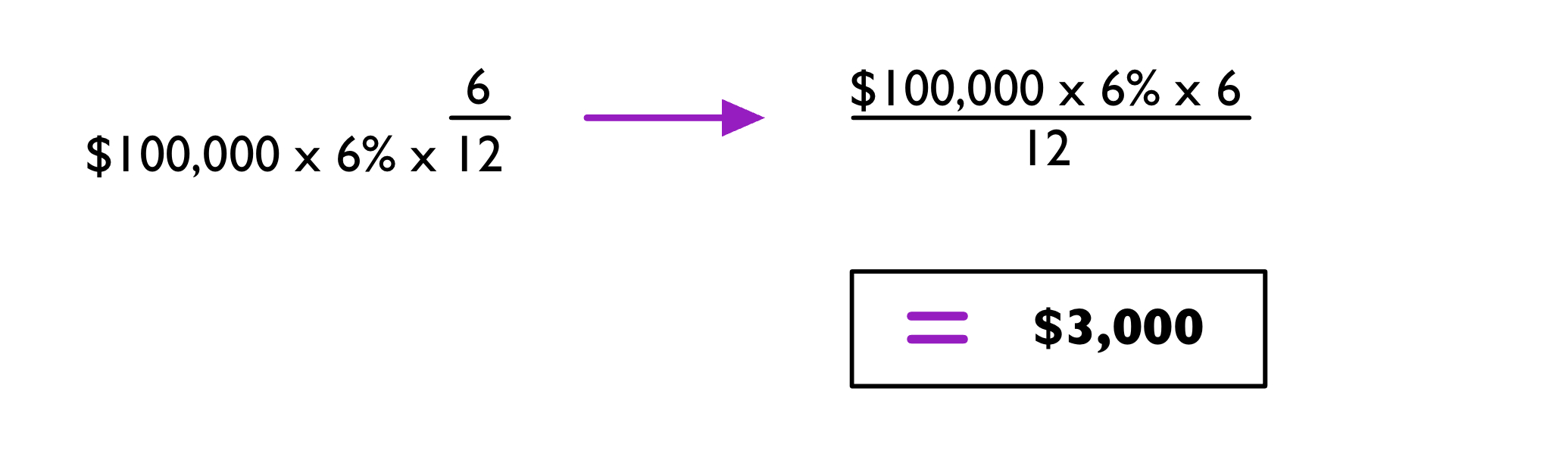

Example: The interest period for a company is from January 1 - June 1 (6 months). The principal is $100,000 and the rate is 6%. What would equation look like and what is the interest?

Principal (P) x Interest Rate (R) x Time (T) = Interest (I)

Time is in terms of months in this example. The interest period (# of months) goes over 12 (total # of months in a year).

$100,000 x 6% x 6/12 = $3,000

Recording Notes Receivable and Interest Revenue

The four key events for a Note Receivable:

Establishing the note.

Accruing interest earned but not received (make an adjusting journal entry).

Recording interest payments received.

Recording principal payments received.

First, do a journal entry that shows the increase of the Note Receivable.

Debit Notes Receivable

Credit Cash

Interest revenue is earned over time.

For this next step, use the formula P x R x T = Interest.

Do the journal entry:

Debit Interest Receivable

Credit Interest Revenue

Third, we calculate the rest of the interest for the remaining time period.

Create the journal entry:

Debit Cash

Credit Interest Receivable

Credit Interest Revenue

Lastly, we create the journal entry for the principal amount of the note

Debit Cash

Credit Note Receivable

Example (part A): On November 1st, 2021, a company lent $100,000 to a business using a note. The business must pay the company 6% interest and $100,000 principal on October 31st, 2022.

Notes Receivable | $100,000 | ||

|---|---|---|---|

Cash | $100,000 |

Example (part B): Accrue the interest at the end of the year (December 31, 2021).

Find the amount of interest to be paid at this time.

P = 100,000; R = 6%; T = 2 months

$100,000 x 6% x 2/12 = $1,000

Interest Receivable | $1,000 | ||

|---|---|---|---|

Interest Revenue | $1,000 |

Example (part C): Received interest at the maturity date (October 31, 2022).

Find the total amount of interest the company earns.

$100,000 x 6% x 12/12 = $6,000

We already received 2 months of interest, so we subtract the $1,000 from $6,000.

$5,000 is the amount we earned in 2022.

Cash | $6,000 (total earned) | ||

|---|---|---|---|

Interest Receivable | $1,000 (earned 2021) | ||

Interest Revenue | $5,000 (earned 2022) |

Example (part D): Record the principal amount from the note that is received on October 31, 2022.

Cash | $100,000 | ||

|---|---|---|---|

Note Receivable | $100,000 |

Objective 8.4: Compute and interpret the receivables turnover ratio.

Receivables Turnover Analysis

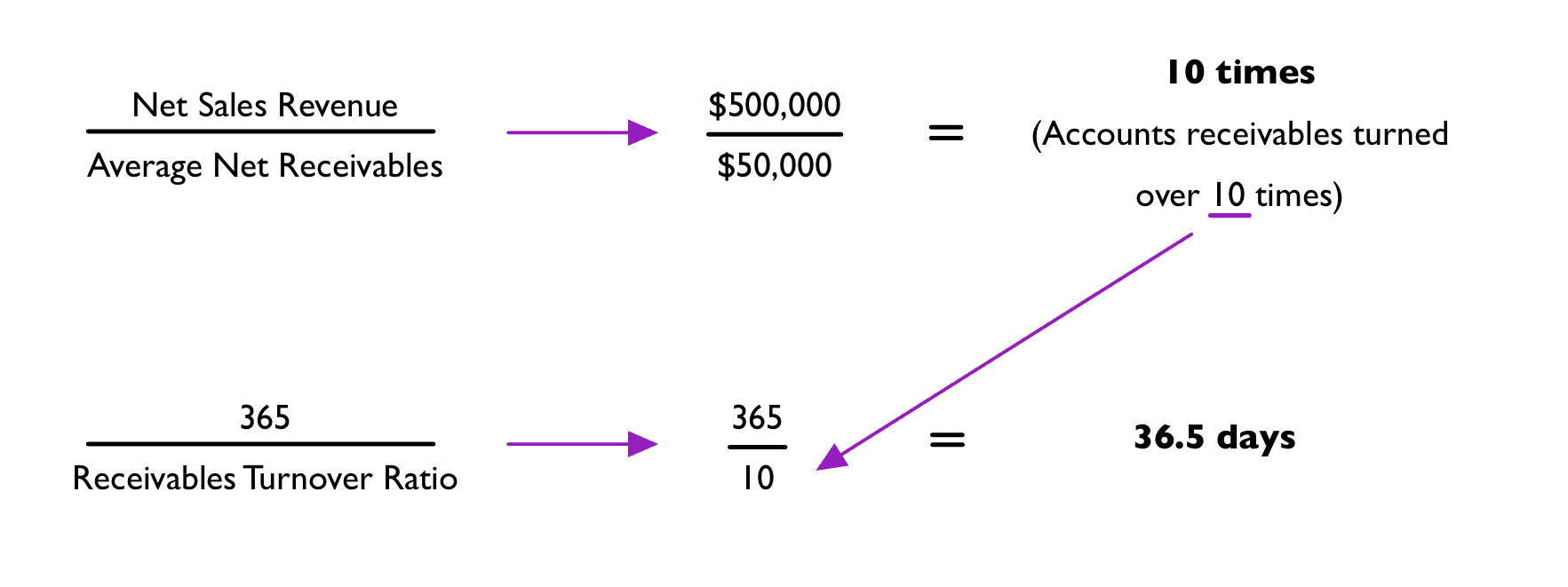

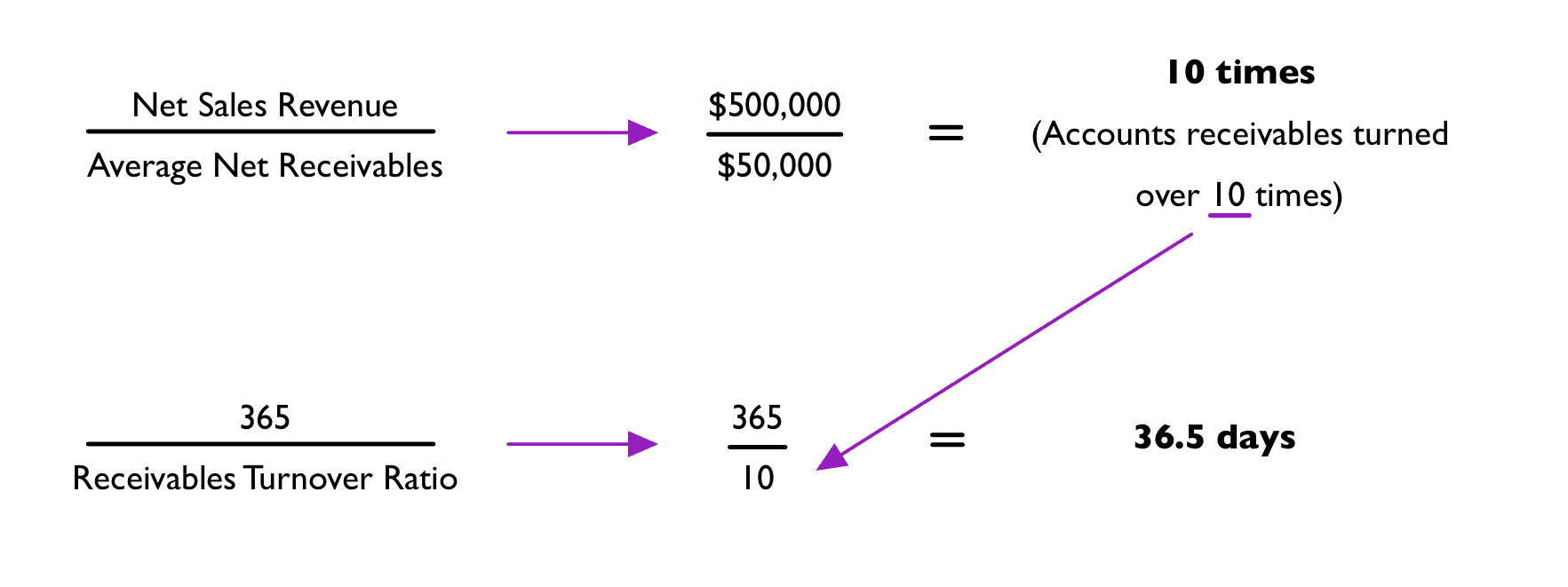

A receivables turnover analysis helps see the effectiveness of a company’s credit-granting and collection activity.

Selling goods or services makes the receivables balance increase.

Collecting the money from customers makes the receivables balance decrease.

Receivables turnover is the constant selling and collecting cycle.

The receivables turnover ratio indicates how many times the cycle is repeated during the accounting period.

The higher the ratio, the faster the collection of receivables.

When the ratio is low, the company is giving their customers too long of a period to pay. Uncollected accounts become a risk.

Days to collect is the number of days to collect receivables.

A higher ratio means it takes more days to collect, but we want a lower ratio.

Equation to calculate the receivable turnover ratio:

Net Sales Revenue/Average Net Receivables = Receivable Turnover Ratio

Equation to calculate days to collect:

365/Receivables Turnover Ratio = Days to Collect

Example: A company has Net Sales Revenue of $500,000 and Average Net Receivables of $50,000.

Comparison to Benchmarks

Credit terms is an agreement between the buyer and seller about the timings and payment to be made for the goods bought on credit.

You can compare the numbers of days to collect to the length of the credit period to see if credit terms are being followed.

Speeding Up Collections

There are two ways you can speed up collections:

Factoring Receivables

Credit Card Sales

A factor is when you sell outstanding accounts to a different company. By doing so, your company is paid for the receivables it sells to the factors. A factoring fee must be considered.

Credit cards speed up cash collection and make it less likely to receive bad checks from customers. Credit card companies so however charge a fee for their services.

Chapter 8: Receivables, Bad Debt Expense, and Interest Revenue

Objective 8.1: Describe the trade-offs of extending credit.

Pros and Cons of Extending Credit

Advantage: Encourages the customer to buy more goods/services, so revenue goes up.

Disadvantages:

Increase in wage costs: Employees are hired to see if someone is creditworthy, see how much money people owe, and to collect from customers.

Bad debt costs: Sometimes people don’t pay what they owe.

Delays receipt of cash: Receiving cash from customers can take 30-60 days.

Objective 8.2: Estimate and report the effects of uncollectible accounts.

Accounts Receivable and Bad Debts

When accounts receivables aren’t fully paid off, it results in bad debt.

There are two objectives in relation to accounts receivable and bad debts:

Accounts Receivable is recorded at the value that is expected to be collected, aka “net realizable value”.

Match (matching principle) the estimated cost of bad debts to the accounting period related credit sales are made.

Both objectives result in a decrease in Accounts Receivable and Net Income by the credit estimated to not be collected.

You must record Sales Revenue and Bad Debt Expense in the same period of the sale. This is called the expense recognition principle (matching).

The allowance method is estimating bad debts that may not be collected and adjusting these estimations later.

Allowance for Doubtful Accounts is a contra account to Accounts Receivable and has a normal credit balance.

When an account can not be collected, the account must be written off.

The balance is removed from Accounts Receivable and Allowance for Doubtful Accounts.

Debit Allowance for Doubtful Accounts

Credit Accounts Receivable

Write offs DO NOT appear on the Income Statement.

Equation to calculate net receivable value:

Accounts Receivable - Allowance for Doubtful Accounts = Net Receivable Value

Journal entries:

Record sales on account:

Debit Accounts Receivable

Credit Sales Revenue

Record estimate of bad debts:

Debit Bad Debt Expense

Credit Allowance for Doubtful Allowance

Bad debt know (“write off” day):

Debit Allowance for Doubtful Accounts

Credit Accounts Receivable

Example: A company sells a bike for $300 to a customer who pays on account. An asset increases and revenues increases.

Accounts Receivable | $300 | ||

|---|---|---|---|

Sales Revenue | $300 |

Example: The company expects to receive $300, but records it estimated bad debt. An expense increases and a contra account increases.

Bad Debt Expense | $300 | ||

|---|---|---|---|

Allowance for Doubtful Accounts | $300 |

Example: The company writes off the bad account. A contra account decreases and the asset decreases.

Allowance for Doubtful Accounts | $300 | ||

|---|---|---|---|

Accounts Receivable | $300 |

Methods for Estimating Bad Debts

There are two methods to calculate the estimate of bad debt: Percentage of Credit Sales Method and Aging of Accounts Receivable

Percentage of Credit Sales Method

Aka the Income Statement Account.

Estimates Bad Debt Expense for the period.

Not very precise.

Equation for estimating bad debt expense (% of credit sales method):

Historical percentage of bad debt loss x Current period’s credit sales

Example: A company has bad debt loss of 3/4. Their credit sales in March totaled $150,000.

Historical percentage of bad debt loss = 75%

Current period’s credit sales = $150,000

$150,000 x 0.0075 = $1,125

Aging of Accounts Receivable

Aka the Balance Sheet Method.

Estimates the ending balance in the Allowance for Doubtful Accounts.

Bases its estimate off of the age of each amount in Accounts Receivable at the end of the accounting period.

If the account receivable is old and overdue, it is less likely to be collected.

More complicated than the first one, but it more accurate.

Steps for the Aging of Accounts Receivable:

Prepare an aged listing of accounts receivable.

Estimate the bad debt loss percentages for each category.

Compute the total estimated bad debts

Example: $5,000 of a company’s Accounts Receivable are estimated to be uncollectible. The unadjusted credit balance for Allowance of Doubt Accounts is $500.

We know that the beginning balance in the Allowance for Doubtful Accounts is $500.

We know the ending balance is $5,000.

We want to fill in what the adjusted entry should look like on the T-account.

Other Issues

We never expect the estimate to match perfectly. There is always going to be a little bit of a difference. If we are significantly off, we have to increase our percentages.

Revising estimates is when a company revises their bad debt estimates for the current period.

Account recovery is reviving written off accounts. The receivable is put back on the books by recording the opposite of what is done for writing off an account. After, a company records the collection of the account.

An example of an account recovery is getting a check in the mail after writing off an account. The company initially thought they would not receive payment, but they did so a journal entry is needed.

There will always be 2 journal entries for a recovery.

Journal entry for reversing the write off:

Debit Accounts Receivable

Credit Allowance for Doubtful Accounts

Journal entry for the collection of the account:

Debit Cash

Credit Accounts Receivable

Example: A company collects $300 for a bike sold, but previously written off. Write the two journal entries: reverse the write off and collect the cash.

Account Receivables | $300 | ||

|---|---|---|---|

Allowance | $300 | ||

Cash | $300 | ||

Accounts Receivable | $300 |

Objective 8.3: Compute and report interest on notes receivable.

Notes Receivable and Interest Revenue

A Notes Receivable is reported when a promissory note is used for a transaction. It has a stronger legal claim.

Notes receivables charge interest from the date they are created to when they are due.

The day the Notes Receivable is due is called the maturity date.

A company may use a Notes Receivable for:

Loaning money out to employees or businesses.

Receiving extended payment on expensive items.

Switching from Accounts Receivable to Notes Receivable to extend the payment period.

Calculating Interest

Three numbers are needed to calculate interest:

Principal - the amount of the Note Receivable.

Interest Rate - interest percentage charged on the note. They are always an annual percentage.

Time Period - the amount of time covered in the interest. Can be in months or days (12, 365)

Equation to calculate interest:

Principal (P) x Interest Rate (R) x Time (T) = Interest (I)

Example: The interest period for a company is from January 1 - June 1 (6 months). The principal is $100,000 and the rate is 6%. What would equation look like and what is the interest?

Principal (P) x Interest Rate (R) x Time (T) = Interest (I)

Time is in terms of months in this example. The interest period (# of months) goes over 12 (total # of months in a year).

$100,000 x 6% x 6/12 = $3,000

Recording Notes Receivable and Interest Revenue

The four key events for a Note Receivable:

Establishing the note.

Accruing interest earned but not received (make an adjusting journal entry).

Recording interest payments received.

Recording principal payments received.

First, do a journal entry that shows the increase of the Note Receivable.

Debit Notes Receivable

Credit Cash

Interest revenue is earned over time.

For this next step, use the formula P x R x T = Interest.

Do the journal entry:

Debit Interest Receivable

Credit Interest Revenue

Third, we calculate the rest of the interest for the remaining time period.

Create the journal entry:

Debit Cash

Credit Interest Receivable

Credit Interest Revenue

Lastly, we create the journal entry for the principal amount of the note

Debit Cash

Credit Note Receivable

Example (part A): On November 1st, 2021, a company lent $100,000 to a business using a note. The business must pay the company 6% interest and $100,000 principal on October 31st, 2022.

Notes Receivable | $100,000 | ||

|---|---|---|---|

Cash | $100,000 |

Example (part B): Accrue the interest at the end of the year (December 31, 2021).

Find the amount of interest to be paid at this time.

P = 100,000; R = 6%; T = 2 months

$100,000 x 6% x 2/12 = $1,000

Interest Receivable | $1,000 | ||

|---|---|---|---|

Interest Revenue | $1,000 |

Example (part C): Received interest at the maturity date (October 31, 2022).

Find the total amount of interest the company earns.

$100,000 x 6% x 12/12 = $6,000

We already received 2 months of interest, so we subtract the $1,000 from $6,000.

$5,000 is the amount we earned in 2022.

Cash | $6,000 (total earned) | ||

|---|---|---|---|

Interest Receivable | $1,000 (earned 2021) | ||

Interest Revenue | $5,000 (earned 2022) |

Example (part D): Record the principal amount from the note that is received on October 31, 2022.

Cash | $100,000 | ||

|---|---|---|---|

Note Receivable | $100,000 |

Objective 8.4: Compute and interpret the receivables turnover ratio.

Receivables Turnover Analysis

A receivables turnover analysis helps see the effectiveness of a company’s credit-granting and collection activity.

Selling goods or services makes the receivables balance increase.

Collecting the money from customers makes the receivables balance decrease.

Receivables turnover is the constant selling and collecting cycle.

The receivables turnover ratio indicates how many times the cycle is repeated during the accounting period.

The higher the ratio, the faster the collection of receivables.

When the ratio is low, the company is giving their customers too long of a period to pay. Uncollected accounts become a risk.

Days to collect is the number of days to collect receivables.

A higher ratio means it takes more days to collect, but we want a lower ratio.

Equation to calculate the receivable turnover ratio:

Net Sales Revenue/Average Net Receivables = Receivable Turnover Ratio

Equation to calculate days to collect:

365/Receivables Turnover Ratio = Days to Collect

Example: A company has Net Sales Revenue of $500,000 and Average Net Receivables of $50,000.

Comparison to Benchmarks

Credit terms is an agreement between the buyer and seller about the timings and payment to be made for the goods bought on credit.

You can compare the numbers of days to collect to the length of the credit period to see if credit terms are being followed.

Speeding Up Collections

There are two ways you can speed up collections:

Factoring Receivables

Credit Card Sales

A factor is when you sell outstanding accounts to a different company. By doing so, your company is paid for the receivables it sells to the factors. A factoring fee must be considered.

Credit cards speed up cash collection and make it less likely to receive bad checks from customers. Credit card companies so however charge a fee for their services.

Knowt

Knowt