Ch 10 - Resource Markets with Application to Labor

(Microeconomics)

The application of labour refers to the job path in which we choose to take and how it affects us as individuals and consumers in an economy. In turn, our ability to purchase goods and services affects the market too as a whole. This chapter focuses on such things, and what being a functional members of society looks like.

Key Concepts to Factor Markets

Derived Demand: a Factor Market is a collection of the four resources which are essential for production, also known as the factors of production (land, labour, capital entrepreneurs). Derived demand relates both the factor market and the product. These two are directly related as the demand for products = demand for factors of production. For example, a service or good would not exist if it weren’t for the factors which produced it. Without the availability of factors of production, these products would not be produced.

The Marginal Revenue Product (MRP): when extra input is employed (labor), it increases a firm’s revenue subsequently, which is what MRP is. The graph represents a downsloping demand curve which indicates that additional labor will increase its revenue.

MRP formula: MP*P

The Marginal Factor Cost (MFC): also known as the marginal resource cost or MRC, which is the downside of employing additional labour as it will lead to loss of revenue.

The least cost rule: states that in an effort to minimise costs, firms will adjust or shift the ratio of inputs until capital is equal to labour. It is very typical of firms to aim to produce at the least possible cost.

Monopsony: is when only one buyer of a good or service exists, meaning that the buyer is capable of setting the price. This is considered to be the monopoly of the factor market. A downside of this is occurs when those in charge underpay workers than they normally would in a competitive market.

Factors: These are able to shift the demand and supply for specific resources. A decrease in labour costs will decrease the demand for workers in other sections.

Marginal Revenue Product (MRP) and Marginal Factor Cost (MFC):

Employers tend to evaluate whether the additional revenue generated is greater than the cost of hiring a worker, which is one of the main reasons why employees do not often get replaced.

The Marginal Revenue Product (MRP): addition to the firm’s revenue in the event where additional input is employed.

MRP = Change in total revenue / Change in resource quantity

MP*P (Perfect competition). Or MP times MR

Finding the MRP is the first step, the next step is to determine the value of labour in the factor market when calculating the Marginal factor Cost (MFC). MFC is the added costs to a firm in the event where they hire additional input such as a machine or worker.

MFC = Change in total resource cost / change in resource quantity = Wage

TIP: A firm continues to maximise profits by hiring inputs in production in case if MRP>MFC. This is up until the point of the profit maximising point is MRP=MFC. if MRP<MFC, the firm will stop using that input as it costs more than what the firms produces in revenue.

The Determinants of Resource Demand

Changes in the Product Demanded; an increase in the price of a product increases the resources used in production and the MRP. In the end, more labour will be hired to make up for this.

Changes in Productivity; An increase in productivity is able to make a firm more profitable. It also provides the firm with a chance to employ more resources (labour) and make use of the increased productivity.

Changes in the prices of other resources;

Substitute resources: firms would opt to use the less costly method of production, especially when there are substitute resources, as it causes a downward shift of the MRP

Complementary resources: as the price of a resources decreases (example: a resource to build houses), more output will be produced (example: houses). This increases demand for resources related to that output (example: construction workers). This causes as rightward shift of MRP.

Perfectly Competitive Labour Market

This market consists of many firms who hire workers with similar skills and abilities. These firms are wage takers, instead of price makers.

The reason why these firms are wage takers is that they hire a percentage of people to do their labour, which has little influence on the market wage. They must be open to pay their workers a market determined wage rate.

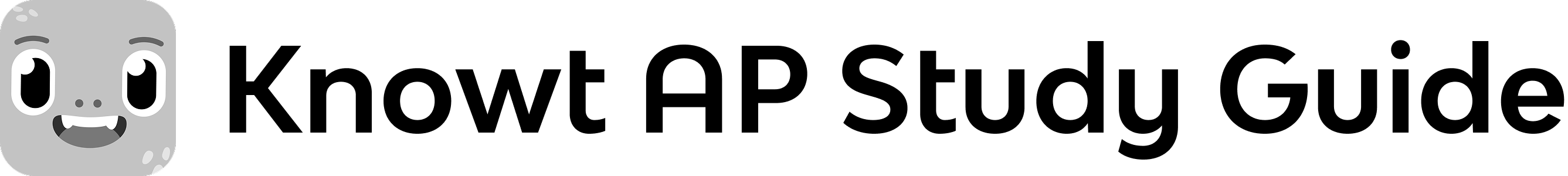

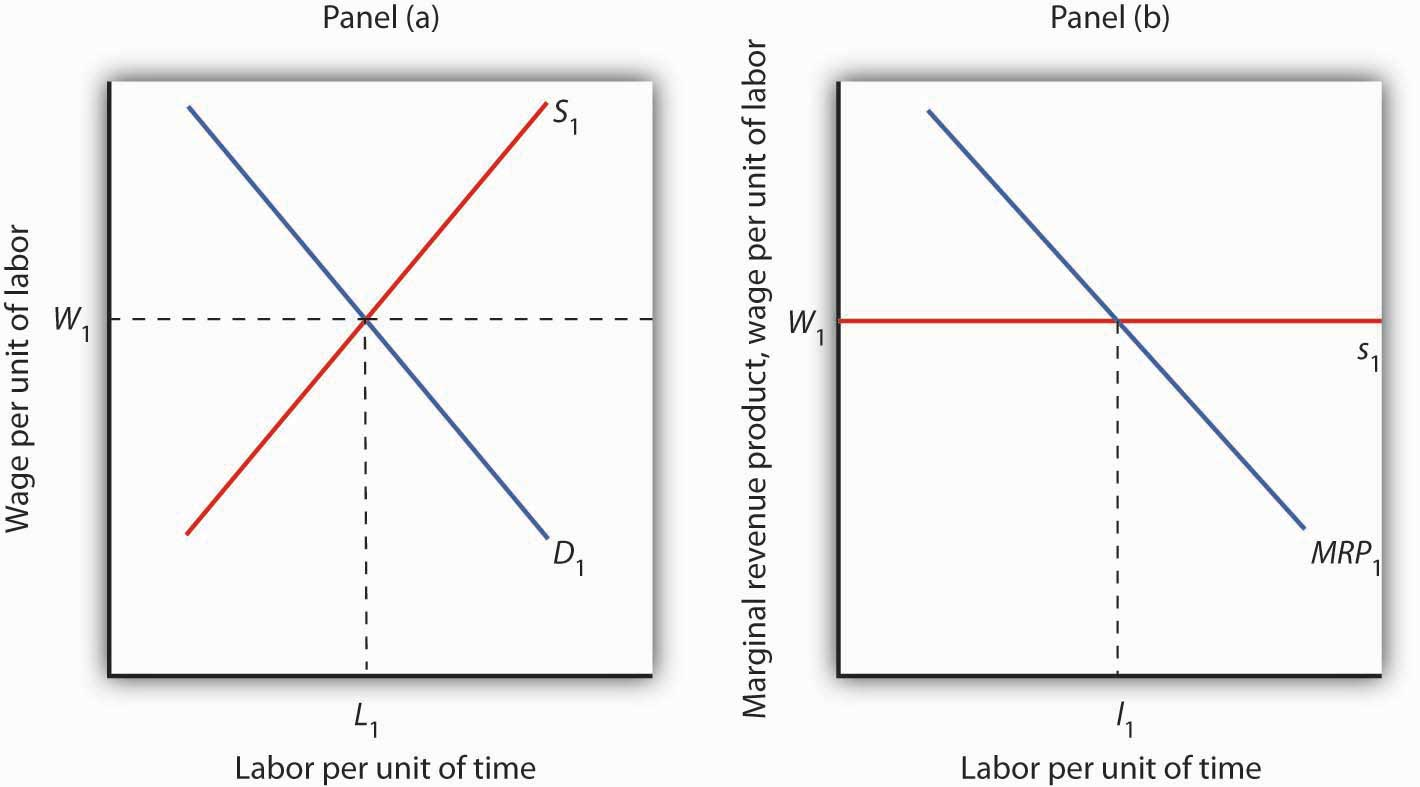

Panel a depicts the perfectly competitive market which is indicated by the equilibrium by demand and supply. Panel B shows a horizontal supply curve for labor at market wage.

The difference is that a perfectly competitive market is related to the product market, while a perfectly competitive labor market is related to the labor market

Minimum Wage

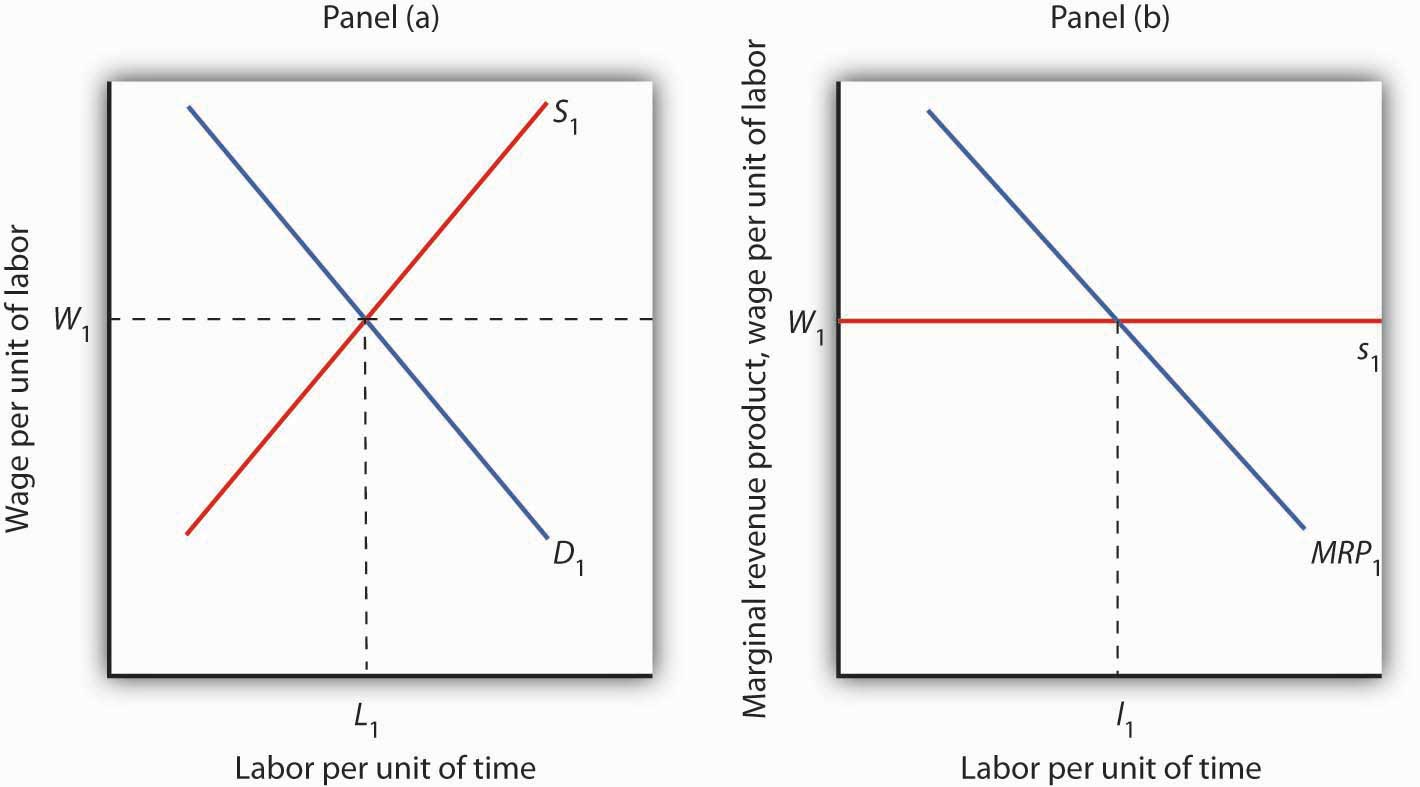

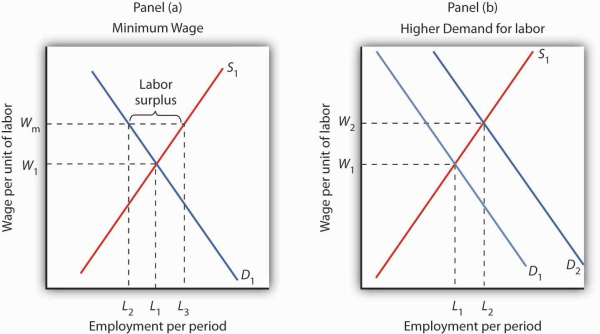

A minimum wage which is effective has a direct effect on the labor market and individual firms. If a price floor for minimum wage is set, the wage will decrease, however, this will lead to a decrease in the quantity hired for workers in the labor market.

In panel A, we can see that as the quantity of labor increases, minimum wage decreases. The same applies for an increase in minimum wage, which decreases labor supplied.

Panel B discusses the same effect of minimum wage and quantity of labor, however, it evaluates how the firm overall will behave, whereas Panel A is focused on the labour market as a whole.

Monopsony

Similar to monopoly, however, in this case there is only a one sole buyer of this labor.

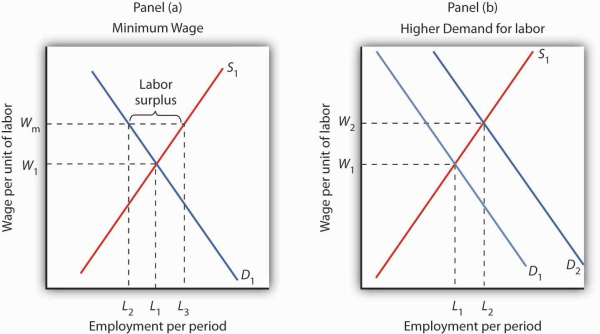

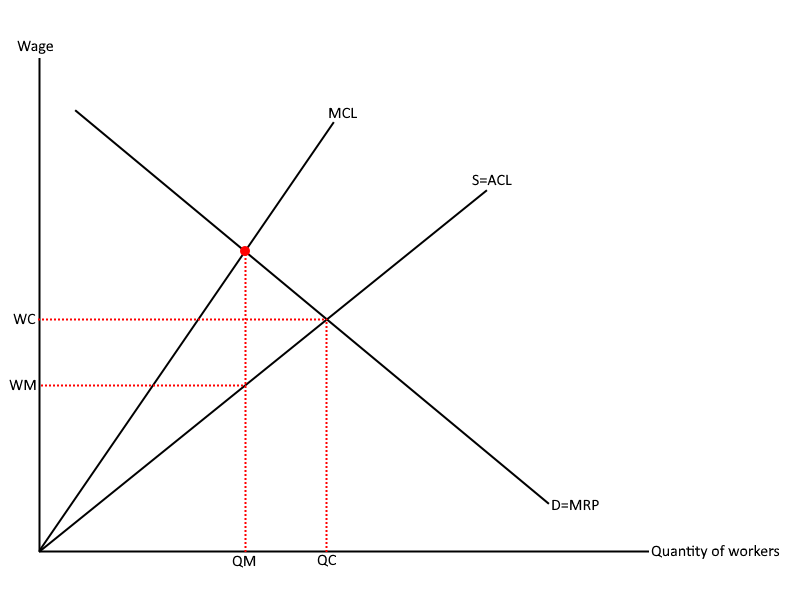

In this graph, we can see that it consists of two upward sloping curves. The MCL (marginal cost of labor) curve increases at a faster rate than the supply curve since a monopsony is not able to discriminate in wages.

As more workers are hired, their wages must also increase proportionally. The increase in wages to all workers currently and previously hired will result in the MFC curve being higher than supply. The wages are paid based on the supply curve, so in a monopsony, firms hire fewer workers and pay less than they would in a competitive market.

The least cost rule

Applies on multiple inputs and states that in order to maximise costs, a firm will adjust the ratio of inputs unit the marginal product of labor which is divided by the price is equal to the marginal product of capital divided by the price.

Producers attempt to find the cost minimising combination from two different inputs such as labor and capital for example.

Least-cost rule formula: where L is labor and K is capital

MP(L)/P(L) = MP(K)/P(K)

The idea behind this is that as firms use a lot of one resource, the productivity of the input decreases according to the law of diminishing returns. The firm will be in need of more labor and will opt to hire more labor as its use of capital decreases.

Ch 10 - Resource Markets with Application to Labor

(Microeconomics)

The application of labour refers to the job path in which we choose to take and how it affects us as individuals and consumers in an economy. In turn, our ability to purchase goods and services affects the market too as a whole. This chapter focuses on such things, and what being a functional members of society looks like.

Key Concepts to Factor Markets

Derived Demand: a Factor Market is a collection of the four resources which are essential for production, also known as the factors of production (land, labour, capital entrepreneurs). Derived demand relates both the factor market and the product. These two are directly related as the demand for products = demand for factors of production. For example, a service or good would not exist if it weren’t for the factors which produced it. Without the availability of factors of production, these products would not be produced.

The Marginal Revenue Product (MRP): when extra input is employed (labor), it increases a firm’s revenue subsequently, which is what MRP is. The graph represents a downsloping demand curve which indicates that additional labor will increase its revenue.

MRP formula: MP*P

The Marginal Factor Cost (MFC): also known as the marginal resource cost or MRC, which is the downside of employing additional labour as it will lead to loss of revenue.

The least cost rule: states that in an effort to minimise costs, firms will adjust or shift the ratio of inputs until capital is equal to labour. It is very typical of firms to aim to produce at the least possible cost.

Monopsony: is when only one buyer of a good or service exists, meaning that the buyer is capable of setting the price. This is considered to be the monopoly of the factor market. A downside of this is occurs when those in charge underpay workers than they normally would in a competitive market.

Factors: These are able to shift the demand and supply for specific resources. A decrease in labour costs will decrease the demand for workers in other sections.

Marginal Revenue Product (MRP) and Marginal Factor Cost (MFC):

Employers tend to evaluate whether the additional revenue generated is greater than the cost of hiring a worker, which is one of the main reasons why employees do not often get replaced.

The Marginal Revenue Product (MRP): addition to the firm’s revenue in the event where additional input is employed.

MRP = Change in total revenue / Change in resource quantity

MP*P (Perfect competition). Or MP times MR

Finding the MRP is the first step, the next step is to determine the value of labour in the factor market when calculating the Marginal factor Cost (MFC). MFC is the added costs to a firm in the event where they hire additional input such as a machine or worker.

MFC = Change in total resource cost / change in resource quantity = Wage

TIP: A firm continues to maximise profits by hiring inputs in production in case if MRP>MFC. This is up until the point of the profit maximising point is MRP=MFC. if MRP<MFC, the firm will stop using that input as it costs more than what the firms produces in revenue.

The Determinants of Resource Demand

Changes in the Product Demanded; an increase in the price of a product increases the resources used in production and the MRP. In the end, more labour will be hired to make up for this.

Changes in Productivity; An increase in productivity is able to make a firm more profitable. It also provides the firm with a chance to employ more resources (labour) and make use of the increased productivity.

Changes in the prices of other resources;

Substitute resources: firms would opt to use the less costly method of production, especially when there are substitute resources, as it causes a downward shift of the MRP

Complementary resources: as the price of a resources decreases (example: a resource to build houses), more output will be produced (example: houses). This increases demand for resources related to that output (example: construction workers). This causes as rightward shift of MRP.

Perfectly Competitive Labour Market

This market consists of many firms who hire workers with similar skills and abilities. These firms are wage takers, instead of price makers.

The reason why these firms are wage takers is that they hire a percentage of people to do their labour, which has little influence on the market wage. They must be open to pay their workers a market determined wage rate.

Panel a depicts the perfectly competitive market which is indicated by the equilibrium by demand and supply. Panel B shows a horizontal supply curve for labor at market wage.

The difference is that a perfectly competitive market is related to the product market, while a perfectly competitive labor market is related to the labor market

Minimum Wage

A minimum wage which is effective has a direct effect on the labor market and individual firms. If a price floor for minimum wage is set, the wage will decrease, however, this will lead to a decrease in the quantity hired for workers in the labor market.

In panel A, we can see that as the quantity of labor increases, minimum wage decreases. The same applies for an increase in minimum wage, which decreases labor supplied.

Panel B discusses the same effect of minimum wage and quantity of labor, however, it evaluates how the firm overall will behave, whereas Panel A is focused on the labour market as a whole.

Monopsony

Similar to monopoly, however, in this case there is only a one sole buyer of this labor.

In this graph, we can see that it consists of two upward sloping curves. The MCL (marginal cost of labor) curve increases at a faster rate than the supply curve since a monopsony is not able to discriminate in wages.

As more workers are hired, their wages must also increase proportionally. The increase in wages to all workers currently and previously hired will result in the MFC curve being higher than supply. The wages are paid based on the supply curve, so in a monopsony, firms hire fewer workers and pay less than they would in a competitive market.

The least cost rule

Applies on multiple inputs and states that in order to maximise costs, a firm will adjust the ratio of inputs unit the marginal product of labor which is divided by the price is equal to the marginal product of capital divided by the price.

Producers attempt to find the cost minimising combination from two different inputs such as labor and capital for example.

Least-cost rule formula: where L is labor and K is capital

MP(L)/P(L) = MP(K)/P(K)

The idea behind this is that as firms use a lot of one resource, the productivity of the input decreases according to the law of diminishing returns. The firm will be in need of more labor and will opt to hire more labor as its use of capital decreases.

Knowt

Knowt