Chapters 28.1-28.2: Money, banking, financial institutions

The Functions of Money

3 Functions

Medium of exchange::

Any item sellers generally accept and buyers generally use to pay for a good or service; money; a convenient means of exchanging goods and services without engaging in barter.

a baker doesn’t want to be paid 200 bagels per week, but everyone accepts money as payment

money is a social invention that can buy any of the full range of items available in the marketplace

Unit of account::

A standard unit in which prices can be stated and the value of goods and services can be compared

Only need to state the price in monetary unit (not corn, crayons, and cranberries)

Money aids rational decision making by enabling buyers and sellers to easily compare the prices of various goods, services, and resources.

Also lets us define debt obligations, determine taxes owed, and calculate GDP.

Store of value::

An asset set aside for future use

enables people to transfer purchasing power from the present to the future by storing some of their wealth as money.

The money you place in a safe or a checking account will still be available to you a few weeks or months from now.

Liquidity

Wealth can be stored as a variety of assets besides money (real estate, stocks, bonds, metals, collectibles like art, etc) but money has the advantage of the most liquidity or spendability

Liquidity::

the ease with which an asset can be converted quickly into the most widely accepted and easily spent form of money (cash) with little or no loss of purchasing power

The more liquid an asset is, the more quickly it can be converted into cash and used for either purchases of goods and services or purchases of other assets.

cash is perfectly liquid (the most liquid form of money over coins, deposits, etc)

a house is highly illiquid

it may take several months before a house is sold so the value can be converted into cash.

there is a loss of purchasing power when the house is sold because numerous fees have to be paid to complete the sale.

The Components of the Money Supply

Money is a “stock” of some item or group of items (unlike income, for example, which is a “flow”)

Anything that is widely accepted as a medium of exchange can serve as money (paper, whales’ teeth, stones, etc)

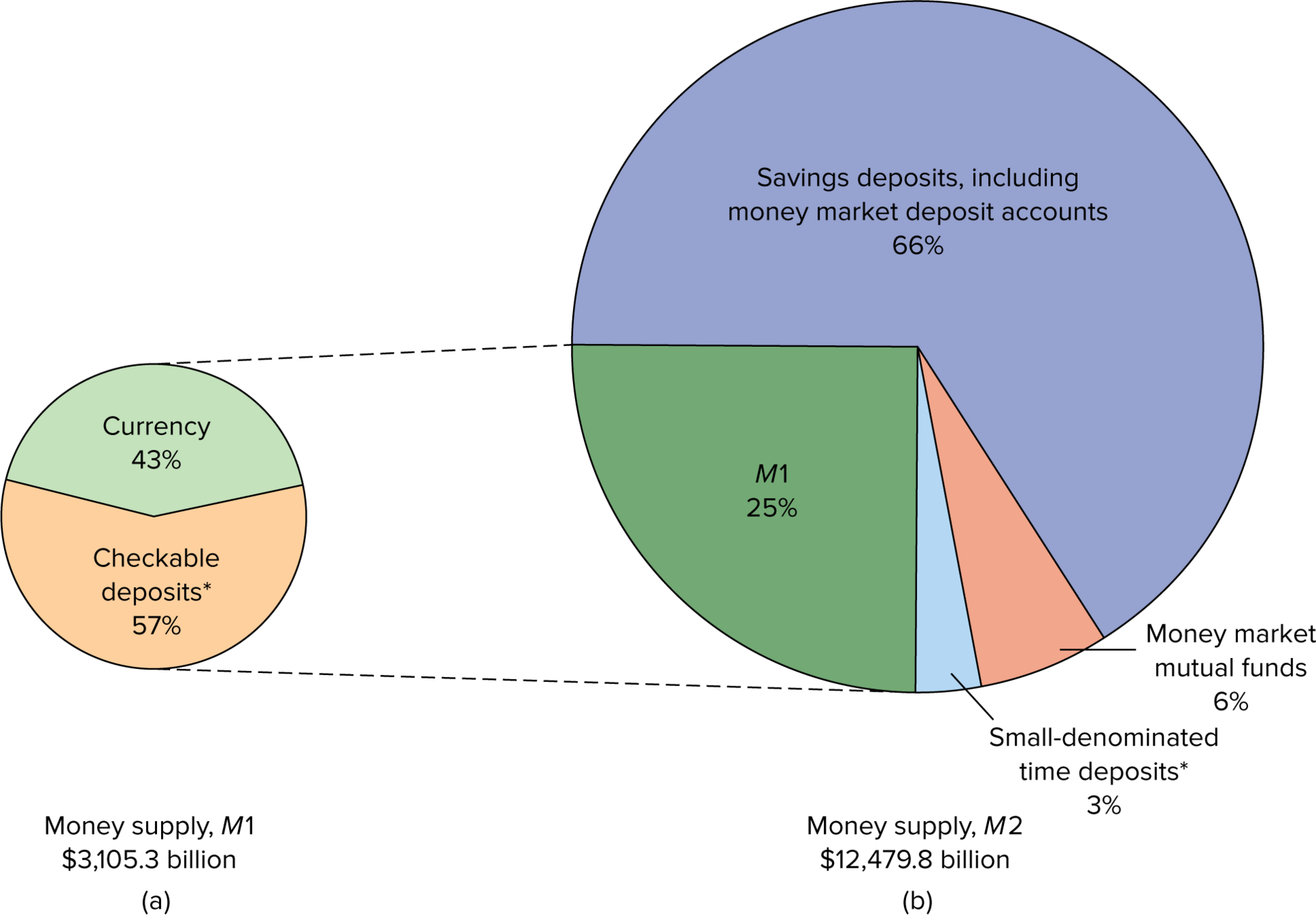

Money Definition M1

narrowest definition of the U.S. money supply. It contains:

1. Currency (coins and paper money) in the hands of the public.

2. All checkable deposits (all deposits in commercial banks and “thrift” or savings institutions on which checks of any size can be drawn).

Government and government agencies supply coins and paper money.

Commercial banks (“banks”) and savings institutions (“thrifts”) provide checkable deposits.

1. Currency: Coins + Paper Money (43% of M1)

The currency of the United States consists of metal coins and paper money

US Treasury

Issues coins

U.S. Mint

Mints coins

Bureau of Engraving and Printing

Prints paper money

Federal Reserve System (the U.S. central bank)

Issues Federal Reserve Notes, which makes up paper money

Federal reserve notes are paper money issued by the Federal Reserve Banks

the currency of the United States is token money

token money::

the face value of any piece of currency is unrelated to its intrinsic value—the value of the physical material (metal or paper and ink) out of which that piece of currency is constructed

Governments make sure that face values exceed intrinsic values to discourage people from destroying coins and bills to resell the material that they are made out of

ex. if a dime’s metal is worth more than $0.10, people would melt the dime and sell the metal

2. Checkable Deposits (57% of M1)

Checkable deposit::

Any deposit in a commercial bank or thrift institution against which a check may be written.

Safer than paying large amounts of money by mailing bills

The person cashing a check must endorse it (sign it on the reverse side); the writer of the check subsequently receives a record of the cashed check as a receipt attesting to the fulfillment of the obligation.

because the writing of a check requires endorsement, the theft or loss of your checkbook is not as severe as losing an identical amount of currency

also more convenient to write a check than to transport and count out a large sum of currency

Checking account balances are part of the money supply

checks are simply a way to transfer the ownership of deposits in banks and other financial institutions

checks are less generally accepted than currency for small purchases, but for major purchases most sellers willingly accept checks as payment.

people can convert checkable deposits into paper money and coins on demand; checks drawn on those deposits are thus the equivalent of currency.

Money, M1 = currency + checkable deposits

Institutions That Offer Checkable Deposits

a variety of financial institutions allow customers to write checks in any amount on the funds they have deposited.

1. Commercial banks are the primary depository institutions

Commercial bank::

A firm that engages in the business of banking (accepts deposits, offers checking accounts, and makes loans).

accept the deposits of households and businesses, keep the money safe until it is demanded via checks, and in the meantime use it to make available a wide variety of loans.

Commercial bank loans provide short term financial capital to businesses and finance consumer purchases of automobiles and other durable goods

2. Thrift institutions, or simply “thrifts.”

Thrift institution::

A savings and loan association (S&Ls), mutual savings bank, or credit union.

Savings and loan associations and mutual savings banks::

accept the deposits of households and businesses and then use the funds to finance housing mortgages and to provide other loans.

Credit unions::

accept deposits from and lend to “members,” who usually are a group of people who work for the same company.

The checkable deposits of banks and thrifts are known as demand deposits, NOW (negotiable order of withdrawal) accounts, ATS (automatic transfer service) accounts, and share draft accounts.

Their commonality is that depositors can write checks on them whenever and in whatever amount they choose.

What are excluded from the money supply?

currency (paper and coins) held by the U.S. Treasury, the Federal Reserve banks, commercial banks, and thrift institutions

Double counting can happen if someone’s paper dollar is counted but also counted when they deposit the dollar into their checkable bank deposit

Therefore we exclude currency held by banks when determining the total supply of money

checkable deposits of the government (specifically, the U.S. Treasury) or the Federal Reserve that are held by commercial banks or thrift institutions.

enables a better assessment of the amount of money available to the private sector for potential spending.

amount of money available to households and businesses is of keen interest to the Federal Reserve in conducting its monetary policy

Money Definition M2

A second and broader definition of money that includes M1 plus several near-monies.

Near-monies::

certain highly liquid financial assets that do not function directly or fully as a medium of exchange but can be readily converted into currency or checkable deposits.

about 5 times larger than the M1 money supply

3 categories of near-monies

Savings deposits, including money market deposit accounts

A depositor can easily withdraw funds from a savings account at a bank or thrift or simply request that the funds be transferred to a checkable account.

Savings account::

A deposit in a commercial bank or thrift institution on which interest payments are received; generally used for saving rather than daily transactions

A person can also withdraw funds from a money market deposit account (MMDA)

MMDA::

an interest bearing account containing a variety of interest-bearing short-term securities.

have a minimum balance requirement and a limit on how often a person can withdraw funds

Small-denominated (less than $100,000) time deposits

Time deposit::

An interest-earning deposit in a commercial bank or thrift institution that the depositor can withdraw without penalty after the end of a specified period. A person can cash in a CD (certificate of deposit) before the time is over but must pay a severe penalty.

In return for this withdrawal limitation, the financial institution pays a higher interest rate on such deposits than it does on its MMDAs

Money market mutual funds held by individuals

money market mutual funds (MMMFs)::

Mutual funds that invest in short-term securities. Depositors can write checks in minimum amounts or more against their accounts.

a depositor can redeem shares in an MMMF offered by a mutual fund company.

Such companies use the combined funds of individual shareholders to buy interest-bearing short-term credit instruments

Then they offer interest on the MMMF accounts of the shareholders (depositors) who jointly own those financial assets.

The MMMFs in M2 include only the MMMF accounts held by individuals; those held by businesses and other institutions are excluded

Chapters 28.1-28.2: Money, banking, financial institutions

The Functions of Money

3 Functions

Medium of exchange::

Any item sellers generally accept and buyers generally use to pay for a good or service; money; a convenient means of exchanging goods and services without engaging in barter.

a baker doesn’t want to be paid 200 bagels per week, but everyone accepts money as payment

money is a social invention that can buy any of the full range of items available in the marketplace

Unit of account::

A standard unit in which prices can be stated and the value of goods and services can be compared

Only need to state the price in monetary unit (not corn, crayons, and cranberries)

Money aids rational decision making by enabling buyers and sellers to easily compare the prices of various goods, services, and resources.

Also lets us define debt obligations, determine taxes owed, and calculate GDP.

Store of value::

An asset set aside for future use

enables people to transfer purchasing power from the present to the future by storing some of their wealth as money.

The money you place in a safe or a checking account will still be available to you a few weeks or months from now.

Liquidity

Wealth can be stored as a variety of assets besides money (real estate, stocks, bonds, metals, collectibles like art, etc) but money has the advantage of the most liquidity or spendability

Liquidity::

the ease with which an asset can be converted quickly into the most widely accepted and easily spent form of money (cash) with little or no loss of purchasing power

The more liquid an asset is, the more quickly it can be converted into cash and used for either purchases of goods and services or purchases of other assets.

cash is perfectly liquid (the most liquid form of money over coins, deposits, etc)

a house is highly illiquid

it may take several months before a house is sold so the value can be converted into cash.

there is a loss of purchasing power when the house is sold because numerous fees have to be paid to complete the sale.

The Components of the Money Supply

Money is a “stock” of some item or group of items (unlike income, for example, which is a “flow”)

Anything that is widely accepted as a medium of exchange can serve as money (paper, whales’ teeth, stones, etc)

Money Definition M1

narrowest definition of the U.S. money supply. It contains:

1. Currency (coins and paper money) in the hands of the public.

2. All checkable deposits (all deposits in commercial banks and “thrift” or savings institutions on which checks of any size can be drawn).

Government and government agencies supply coins and paper money.

Commercial banks (“banks”) and savings institutions (“thrifts”) provide checkable deposits.

1. Currency: Coins + Paper Money (43% of M1)

The currency of the United States consists of metal coins and paper money

US Treasury

Issues coins

U.S. Mint

Mints coins

Bureau of Engraving and Printing

Prints paper money

Federal Reserve System (the U.S. central bank)

Issues Federal Reserve Notes, which makes up paper money

Federal reserve notes are paper money issued by the Federal Reserve Banks

the currency of the United States is token money

token money::

the face value of any piece of currency is unrelated to its intrinsic value—the value of the physical material (metal or paper and ink) out of which that piece of currency is constructed

Governments make sure that face values exceed intrinsic values to discourage people from destroying coins and bills to resell the material that they are made out of

ex. if a dime’s metal is worth more than $0.10, people would melt the dime and sell the metal

2. Checkable Deposits (57% of M1)

Checkable deposit::

Any deposit in a commercial bank or thrift institution against which a check may be written.

Safer than paying large amounts of money by mailing bills

The person cashing a check must endorse it (sign it on the reverse side); the writer of the check subsequently receives a record of the cashed check as a receipt attesting to the fulfillment of the obligation.

because the writing of a check requires endorsement, the theft or loss of your checkbook is not as severe as losing an identical amount of currency

also more convenient to write a check than to transport and count out a large sum of currency

Checking account balances are part of the money supply

checks are simply a way to transfer the ownership of deposits in banks and other financial institutions

checks are less generally accepted than currency for small purchases, but for major purchases most sellers willingly accept checks as payment.

people can convert checkable deposits into paper money and coins on demand; checks drawn on those deposits are thus the equivalent of currency.

Money, M1 = currency + checkable deposits

Institutions That Offer Checkable Deposits

a variety of financial institutions allow customers to write checks in any amount on the funds they have deposited.

1. Commercial banks are the primary depository institutions

Commercial bank::

A firm that engages in the business of banking (accepts deposits, offers checking accounts, and makes loans).

accept the deposits of households and businesses, keep the money safe until it is demanded via checks, and in the meantime use it to make available a wide variety of loans.

Commercial bank loans provide short term financial capital to businesses and finance consumer purchases of automobiles and other durable goods

2. Thrift institutions, or simply “thrifts.”

Thrift institution::

A savings and loan association (S&Ls), mutual savings bank, or credit union.

Savings and loan associations and mutual savings banks::

accept the deposits of households and businesses and then use the funds to finance housing mortgages and to provide other loans.

Credit unions::

accept deposits from and lend to “members,” who usually are a group of people who work for the same company.

The checkable deposits of banks and thrifts are known as demand deposits, NOW (negotiable order of withdrawal) accounts, ATS (automatic transfer service) accounts, and share draft accounts.

Their commonality is that depositors can write checks on them whenever and in whatever amount they choose.

What are excluded from the money supply?

currency (paper and coins) held by the U.S. Treasury, the Federal Reserve banks, commercial banks, and thrift institutions

Double counting can happen if someone’s paper dollar is counted but also counted when they deposit the dollar into their checkable bank deposit

Therefore we exclude currency held by banks when determining the total supply of money

checkable deposits of the government (specifically, the U.S. Treasury) or the Federal Reserve that are held by commercial banks or thrift institutions.

enables a better assessment of the amount of money available to the private sector for potential spending.

amount of money available to households and businesses is of keen interest to the Federal Reserve in conducting its monetary policy

Money Definition M2

A second and broader definition of money that includes M1 plus several near-monies.

Near-monies::

certain highly liquid financial assets that do not function directly or fully as a medium of exchange but can be readily converted into currency or checkable deposits.

about 5 times larger than the M1 money supply

3 categories of near-monies

Savings deposits, including money market deposit accounts

A depositor can easily withdraw funds from a savings account at a bank or thrift or simply request that the funds be transferred to a checkable account.

Savings account::

A deposit in a commercial bank or thrift institution on which interest payments are received; generally used for saving rather than daily transactions

A person can also withdraw funds from a money market deposit account (MMDA)

MMDA::

an interest bearing account containing a variety of interest-bearing short-term securities.

have a minimum balance requirement and a limit on how often a person can withdraw funds

Small-denominated (less than $100,000) time deposits

Time deposit::

An interest-earning deposit in a commercial bank or thrift institution that the depositor can withdraw without penalty after the end of a specified period. A person can cash in a CD (certificate of deposit) before the time is over but must pay a severe penalty.

In return for this withdrawal limitation, the financial institution pays a higher interest rate on such deposits than it does on its MMDAs

Money market mutual funds held by individuals

money market mutual funds (MMMFs)::

Mutual funds that invest in short-term securities. Depositors can write checks in minimum amounts or more against their accounts.

a depositor can redeem shares in an MMMF offered by a mutual fund company.

Such companies use the combined funds of individual shareholders to buy interest-bearing short-term credit instruments

Then they offer interest on the MMMF accounts of the shareholders (depositors) who jointly own those financial assets.

The MMMFs in M2 include only the MMMF accounts held by individuals; those held by businesses and other institutions are excluded

Knowt

Knowt